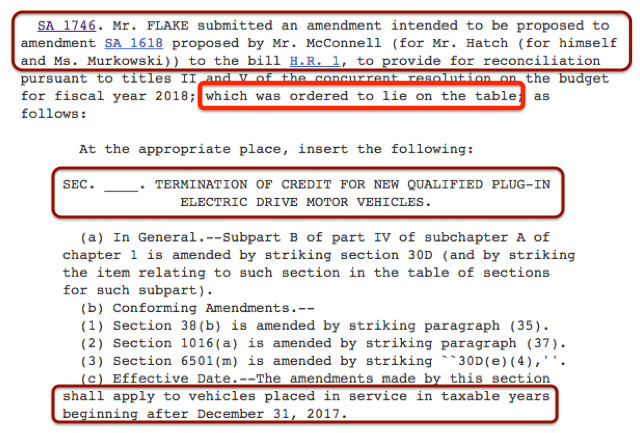

ev tax credit bill text

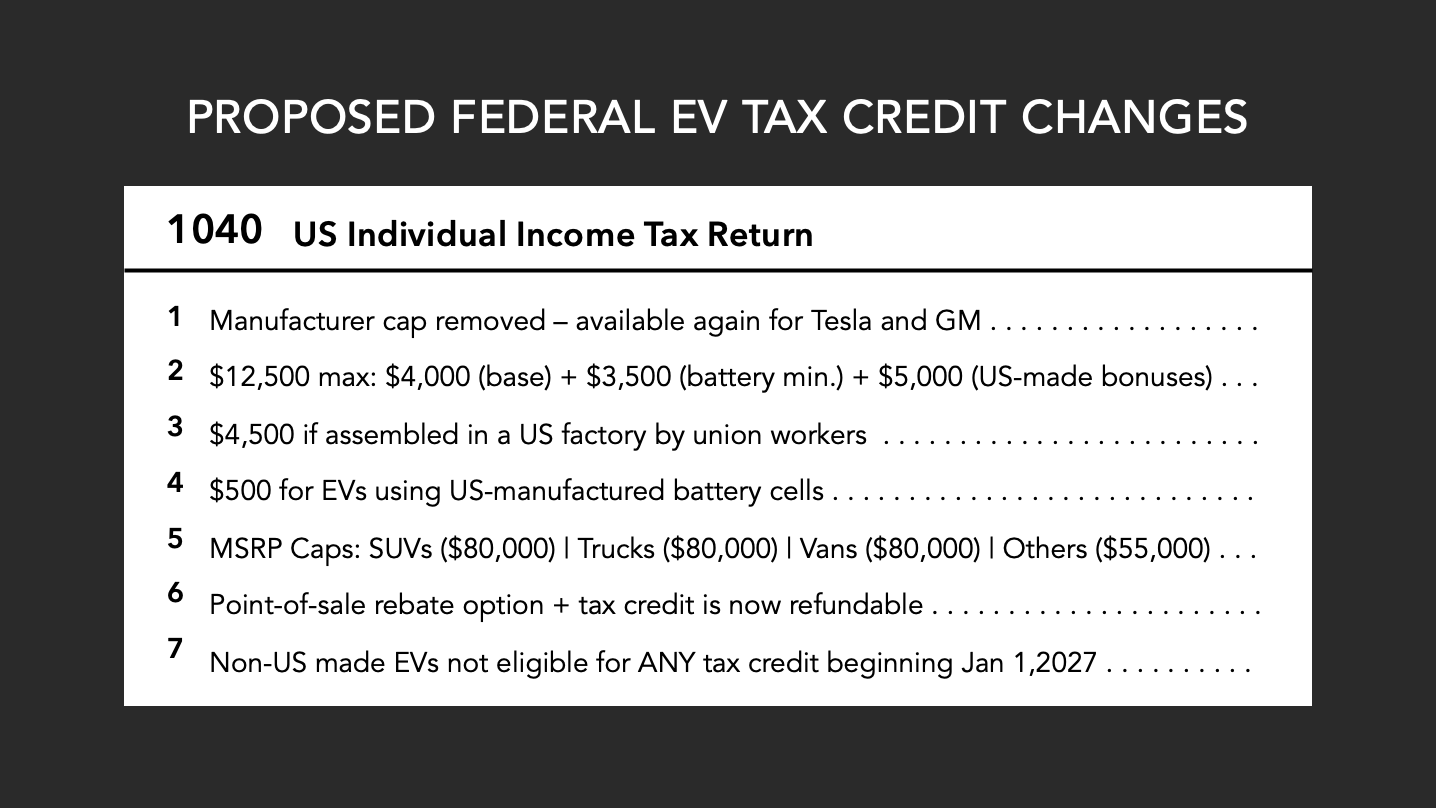

The current tax credit has a base of 2500 and is replaced with a new 4000 base credit as long as the EV has a battery of at least 10 kWh and can be plugged in and recharged. The same provision was included in the.

Oil Industry Cons About The Ev Tax Credit Nrdc

The bill says individual taxpayers must have an adjusted gross income of no more than 400000 to get the new EV tax credit.

. Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to the. Debbie Stabenow D-MI to. Since 2019 the Administration and Legislature have added significant expansions of the Earned Income Tax Credit including expanding the credit to taxpayers with ITINs expanding the credit to every Californian working full time at minimum wage and.

7500 EV tax credit reinstated 2500 for made 2500 for union made. Increasing the base credit amount to 4000 from 2500 is fine. Keep the 7500 incentive for new.

The proposed EV incentive under Build Back Better includes a current 7500 tax credit to purchase a plug-in electric vehicle as well as. It would limit the EV credit to cars priced at. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Introduced in the Senate Referred to Senate Environment and Energy Committee. The bill would provide 75 billion for zero- and low-emission buses and ferries aiming to deliver thousands of electric school buses to districts across the country according to the White House. The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers.

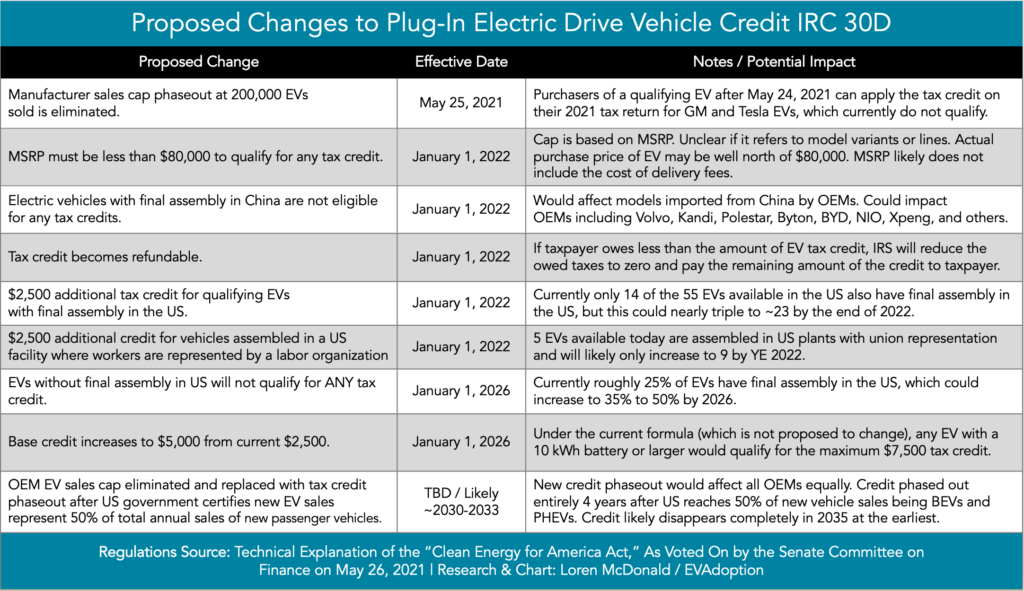

EV tax credit bill from Senate Finance Committee. Some relatively simple math shows the benefits of EVs. The bill also extends the tax credit for hydrogen fuel cell electric vehicles for 10 years which will incentivize the development and deployment of additional low carbon zero tailpipe emissions options which UCS also supports.

Note these exact terms are not confirmed until the bill has been officially passed. According to the latest text of the bill the new benefit could only be used on cars that cost up to 55000. If they pass the new EV tax credits will make the old credits look stingy.

Joe Manchin indicated he was open to returning to the negotiating table to revise the Build Back Better measure months after the Democrat torpedoed his partys sweeping 2 trillion spending. As of Dec. Senate Finance Committee Approves 12500 EV Tax Credit Bill.

4000 Base Tax Credit. The Build Back Better bill which includes robust changes to federal tax credits for EVs will now face the Senate where two vital Democrats have. Here are the steps for.

The current federal EV tax credit of 7500 could increase to 12500 under an amendment that was introduced by Sen. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. B Limitation.

On Wednesday the Senate Finance Committee advanced the Clean Energy for America Act making a few tweaks from earlier proposals. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. Current EV tax credits top out at 7500.

EV Tax Credit Bill Faces Opposition from Tesla Toyota and Republicans Decrease Font Size Increase Font Size Text Size Print This Page Send by Email Pro-EV pro-union bill accused of favoring Big. Federal tax credit for EVs jumps from 7500 to 12500. 19 its a solid maybe.

The credit amount will vary based on the capacity of the battery used to power the vehicle. Another 75 billion would go to building a nationwide network of plug-in electric vehicle chargers according to the bill text. Bill Text 2022-03-03 Provides corporation business tax credit and gross income tax credits for purchase and installation of certain electric vehicle charging stations.

The preliminary text released by Chairman Ron Wyden D-Ore includes a 4500 credit for electric vehicles domestically produced in unionized facilities. By Matt Posky on May 27 2021. This bill has the status Passed House.

What will the bill really do. Rules Committee Print 117-18 includes text as reported by House Committee on the Budget with modifications. Heres how you would qualify for the maximum credit.

A Allowance of credit In the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount equal to 30 percent of the cost of any qualified electric bicycle placed in service by the taxpayer during such taxable year. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles.

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Oil Industry Cons About The Ev Tax Credit Nrdc

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Southern California Edison Incentives

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Oil Industry Cons About The Ev Tax Credit Nrdc

Latest On Tesla Ev Tax Credit March 2022

Latest On Tesla Ev Tax Credit March 2022

Legislation Regulations Evadoption

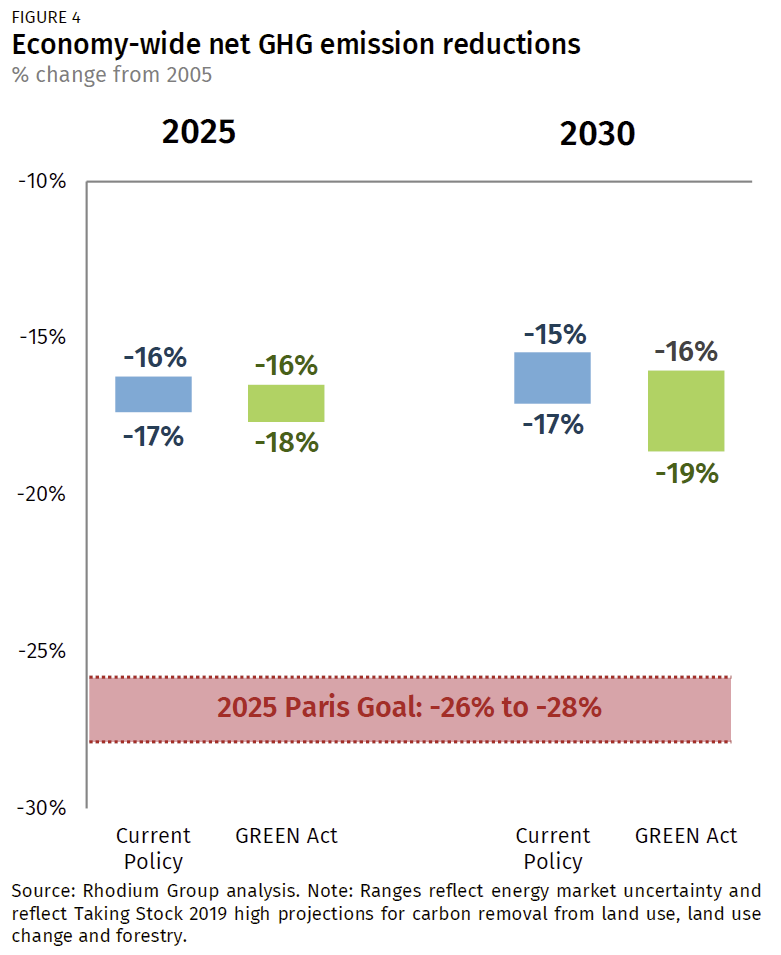

An Assessment Of The Green Act Implications For Emissions And Clean Energy Deployment Rhodium Group

Legislation Regulations Evadoption

Legislation Regulations Evadoption

A Fleet Manager S Guide Electric Vehicle Tax Credits

Plug In Electric Vehicle Policy Center For American Progress