palm beach county business tax receipt phone number

Palm Beach County Tax Collector. The docketing time for an E-Filed pleading is dependent upon the volume of filings received at any given time.

Box 3353 West Palm Beach FL 33402-3353.

. Constitutional Tax Collector Serving Palm Beach County PO. Contact Numbers for Information. Palm Beach County receives in excess of 5 million court documents each year totaling more than 15 million pages.

Property Tax Search Dashes must be used. Call the phone number as early as possible or after 6pm. Looking for FREE property records deeds tax assessments in Broward County FL.

Box 3353West Palm Beach FL 33402-3353. Office Depot OfficeMax Rewards Program Program Terms and Conditions May 1 2022 Membership Eligibility. Investigation Of A Complaint Filed With The Palm Beach County School District PBCSD On May 5 2018 Alleging The Palm Beach County School Board Inspector General Violated His Contract By Conducting Business Unrelated To His Role As Inspector General.

If your business is located within an incorporated municipality city limits a City Business Tax Receipt must be procured before a Brevard County Business Tax Receipt can be issued. These records can include Palm Beach County property tax assessments and assessment challenges appraisals and income taxes. When the office is open a representative will give you a call back.

E-Filing Multiple Documents - The Portal permits multiple documents for the same case to be filed at one time. If you cant pay your ticket in full we can help you establish a monthly payment plan. A Program member Member is eligible to receive Program rewards on purchases made at Office Depot and OfficeMax stores by phone at 18004633768 in Puerto Rico and the US.

Quickly search property records from 25 official databases. Palm Beach County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Palm Beach County Florida. Business Tax Application Exemptions.

RPT 2018 - 30 Follow-Up Audit of Risk Managements Internal Controls Over DAVID Information. Business Owner Enter by Last Name First Name LBTR Number Local Business Tax Receipt Mailing Address. How to make an appointment - Call 1-800-772-1213 or a local office number if they have one between 7 am.

General Maintenance Handyman. Serving Palm Beach CountyPO. Attend driver school in lieu of receiving points on your license.

Set up your appointment. Per County Ordinance 2015-A21 effective July 1 2016 a taxicab business must provide proof of automobile insurance with the minimum limits of 300000 combined single limit CSL when applying for or renewing a Business Tax Receipt. To 7 pm Monday through Friday.

Information pertaining to Business Tax Receipts Brevard County Tax Collectors Office 321-264-6969 or 321-633-2199. Pay your ticket online by mail by phone or in person at one of our courthouse locations.

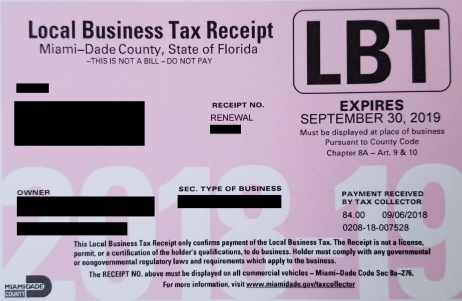

Miami Dade County Local Business Tax Receipt 305 300 0364

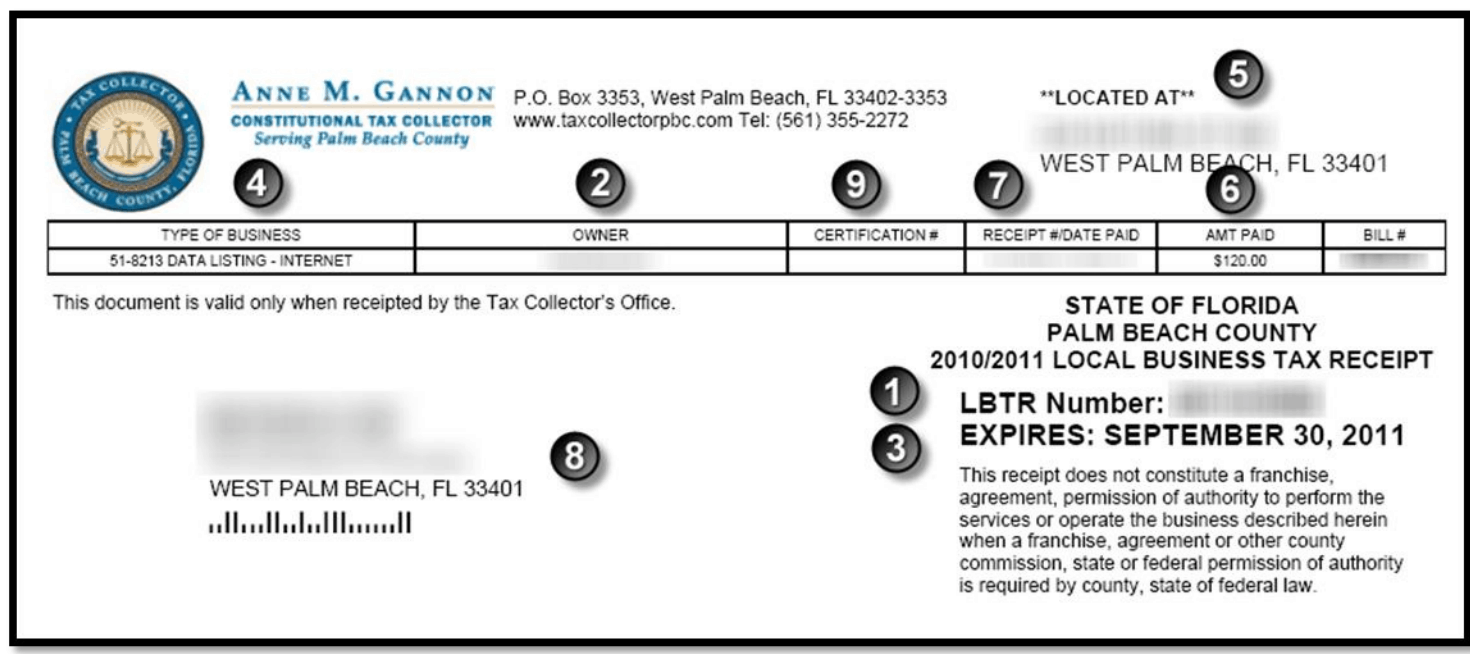

Local Business Tax Constitutional Tax Collector

Palm Beach County Local Business Tax Receipt 305 300 0364

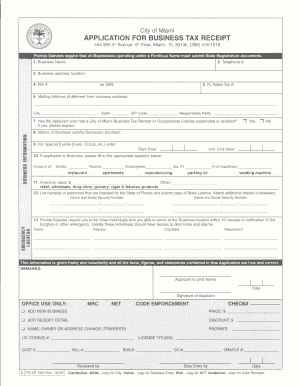

Get And Sign Martin County Florida Business Tax Receipt Application 2006 2022 Form

West Park Area Broward County Local Business Tax Receipt 305 300 0364

Permit Source Information Blog

Local And County Tax Receipt Laws In Palm Beach County

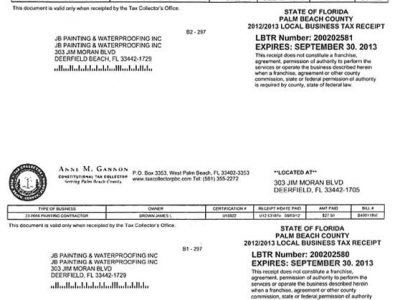

Licences Certificate Of Competency Registration Jb Painting Waterproofing Inc